Cash-flow forecasts for those two subsidiaries have been revised significantly due to the impact of the crisis and improved understanding of the business forecasts for all the business units from the new Antevenio/Rebold scope.

In addition, Antevenio had to write down certain assets, including the goodwill for its French and US subsidiaries, for a combined total of €3.83m. However, operating expenditure was stable compared with the first half of 2019, due to non-recurring costs linked to the restructuring of the management teams and the business combination operation, resulting in an operating loss of €(1.34)m. The regional breakdown of revenues shows 46% of first-half sales were generated in Spain, 25% in Italy, 7% in France, 10% in Latin America (vs 23% for H1 2019) and 13% in North America.ĭuring the first half of the year, Antevenio recorded an 8.8% reduction in staff costs, reflecting the impact of the reorganization rolled out in 2019 and the first measures put in place this year to mitigate the effects of the crisis. However, Marketing Technology sales proved very resilient over the period. The Group's business contracted by 19% during the first half of 2020, impacted by the global health crisis, particularly for its Publishing and Digital Media Trading activities. Significant contraction in business over the first half of 2020 (1) Revenues less volume discounts on ad sales Popular Double Entry Bookkeeping ExamplesĪnother double entry bookkeeping example for you to discover.Operating margin rate (% of net revenues) The use of the Allowance for obsolete inventory account is further explained here.Ī write down is similar to a write off, except that with a write down, the asset is still left with a book value whereas with a write off the value of the asset is reduced to zero. The purpose of the Allowance for obsolete inventory account is to allow the original cost of the inventory to be maintained on the Inventory account until disposed of. In this example, the Inventory account shows a debit balance of 1,000 and the Allowance for obsolete inventory account shows a credit balance a 300, resulting in a net inventory of 700 as required. The Allowance for obsolete inventory account is included on the balance sheet directly below the Inventory account to show a net value of inventory.

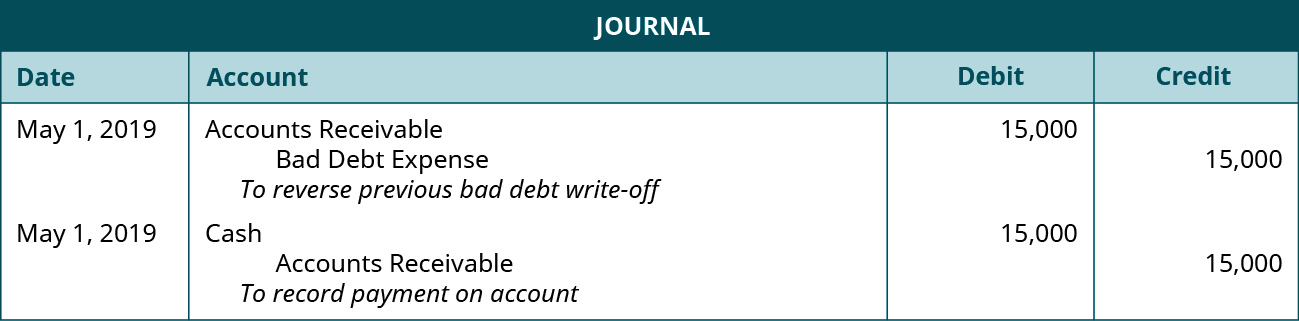

The charge to the income statement reduces the net income which reduces the retained earnings and therefore the owners equity in the business. The income statement has been charged with the 300 as an expense to the Loss on inventory write down account. In this case the asset of inventory has been decreased by a 300 credit to the contra asset account, Allowance for obsolete inventory. At this stage the inventory write down reflects an estimated reduction in the value of the inventory, and the reduction is reflected in the contra asset account of Allowance for obsolete inventory rather than the Inventory account itself. For this transaction the Accounting equation is shown in the following table. This is true at any time and applies to each transaction.

#Writedown reversal balance sheet plus

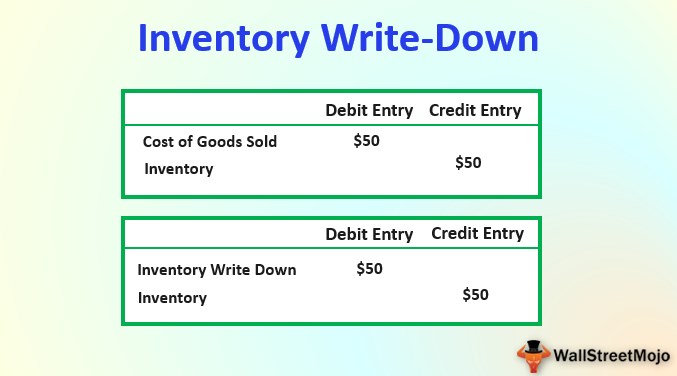

The Accounting Equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business. In effect, this has crested a reserve against which future inventory write offs can be charged. The journal entry also shows the inventory write down being credited to the Allowance for obsolete inventory account. The problem with charging the amount to the cost of goods sold account is that it distorts the gross margin of the business, as there is no corresponding revenue entered for the sale of the product. If the inventory write down is immaterial, then a business will often charge the inventory write down to the Cost of goods sold account.

The journal entry above shows the inventory write down expense being debited to the Loss on inventory write down account. Inventory Write Down Journal Entry Account

0 kommentar(er)

0 kommentar(er)